does south dakota have sales tax on vehicles

The states sales and use tax rate is 45. To be able to collect sales tax a company in South Dakota must have a sales tax collection permit issued.

South Dakota Vehicle Title Donation Questions

However should there be sales tax due the seller becomes fully liable whether the sales tax was collected or not.

. In South Dakota the sales and use tax rate is 45. Though you can save money you know the payments involved to register your car with South Dakota states Motor Vehicle Division. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45. Does South Dakota have sales tax on vehicles. The laws applicable in South Dakota allow a business person to include sales tax on the price of the products or services they offer.

4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable products and services. The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education for our citizens. Do I have to pay an excise tax every time I register my car in South Dakota.

Different areas have varying additional sales taxes as well. First retail sale of vehicle is taxableowned by churches and farm vehicles as defined in 32 18-Motor vehicleboat transferred by a trustor to his trustee or from a trustee to a beneficiary of a trust-19-Vehicle rented for 28 days or less and not consecutively rented for. The average sales tax rate on vehicles across the state is 5814.

The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. South Dakotas sales tax rates for commonly exempted items are as follows. All car sales in South Dakota are subject to the 4 statewide sales tax.

Sales Use Tax. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that applies to the rental of cars trucks motorcycles and vans if the business rents them to the same person for less than 28 days.

This page discusses various sales tax exemptions in South Dakota. 45 Tourism Tax Applies to certain lodging and amusement services. The SD sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

A licensed motor vehicle dealer according to 32-5-27. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. In addition for a car purchased in South Dakota there are other.

You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. However if the vehicle is 11 years or older or is sold for less than 2500 no. Services as well as physical goods make up a significant portion of gross sales and transactions.

This means that an individual in the state of South Dakota who sells school. If you want to buy cars South Dakota is among the top ten most tax and fee-friendly places in the US. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any.

South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The South Dakota sales tax and use tax rates are 45.

Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. Cars sold in private sales in South Dakota are still subject to the car sales tax of 4. 45 The following tax may apply in addition to the state sales tax.

Motor Vehicle Sales and Purchases South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. The tourism tax is used for the promotion of tourism in South Dakota. Certain trailers are also subject to the tax if they are rented for 6.

Sales Tax Exemptions in South Dakota. It is a compulsory requirement for a. 4 Motor Vehicle Gross Receipts Tax Applies to the rental of motorcycles cars trucks and vans for less than 28 days and the rental of certain trailers for 6 months or less.

While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation.

See The New State Seal Specialty Emblem Here South Dakota Department Of Revenue

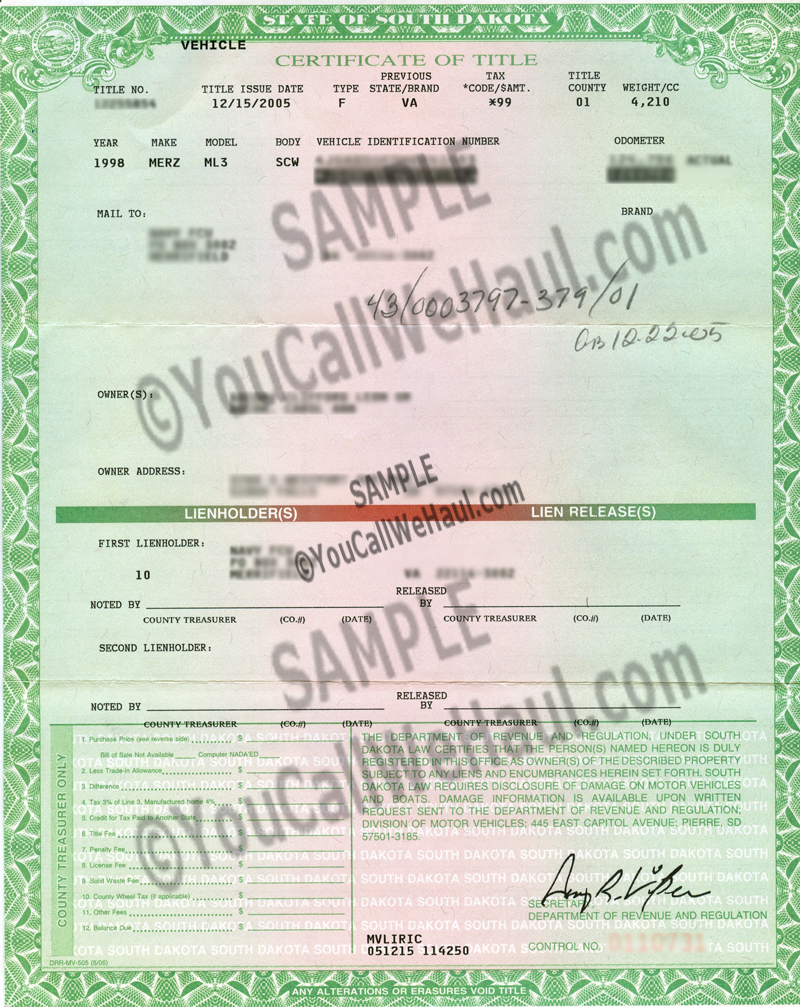

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

Vehicle Registration Service No Emissions Or Inspections Dirt Legal

Motor Fuel South Dakota Department Of Revenue

Dealer Requirements License Plates South Dakota Department Of Revenue

South Dakota License Plates Discover Baja Travel Club

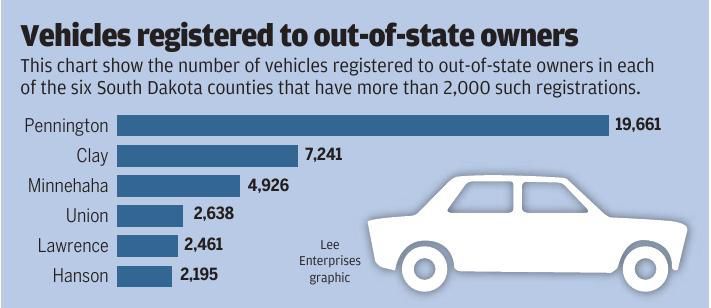

58 334 Out Of State Vehicles Registered In South Dakota Local Rapidcityjournal Com

South Dakota License Plate License Plates In South Dakota Dakotapost

Vehicle Registration Service No Emissions Or Inspections Dirt Legal

Sales Tax On Cars And Vehicles In South Dakota

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

Governor Noem Temporarily Extends Registration Renewals And Titling Newly Acquired Vehicles Knbn Newscenter1

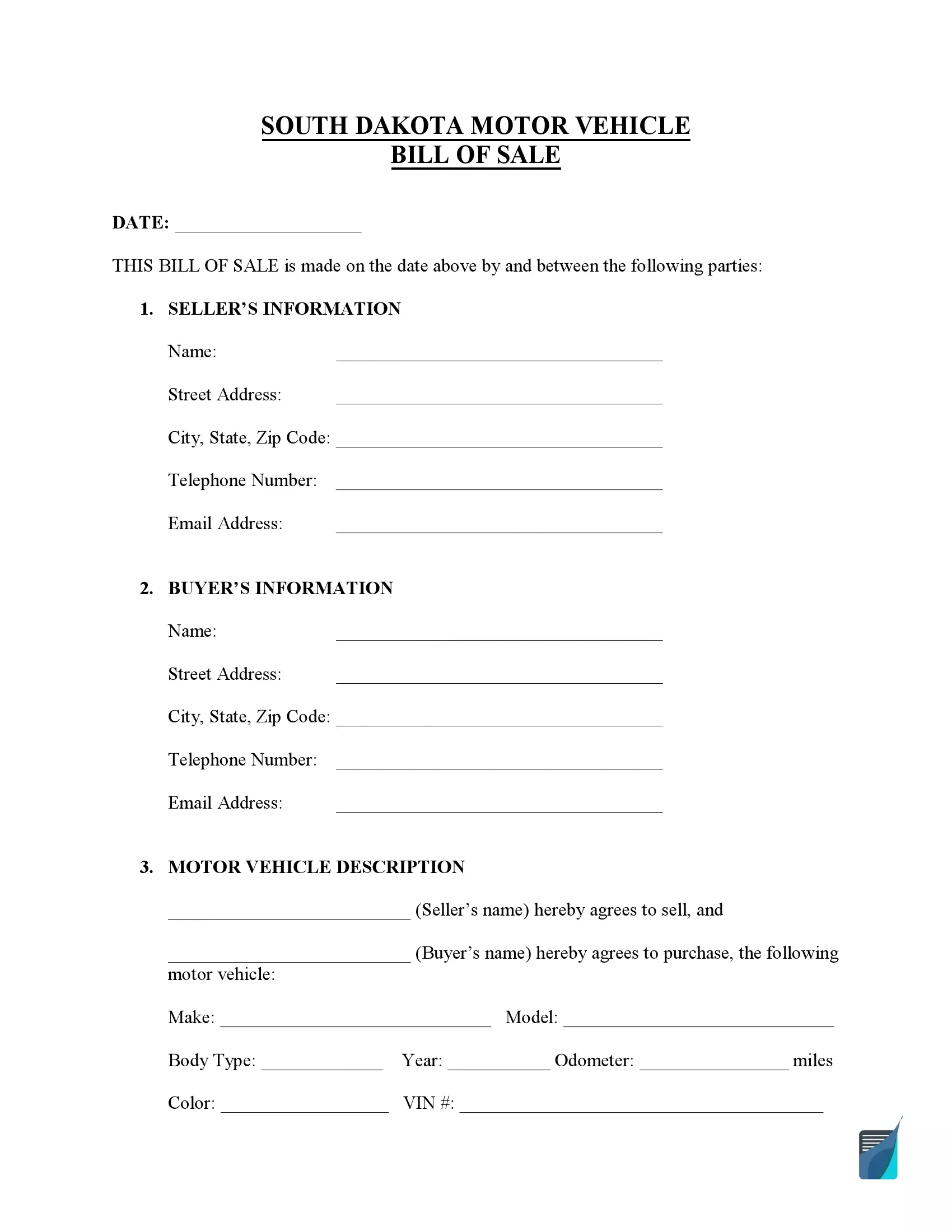

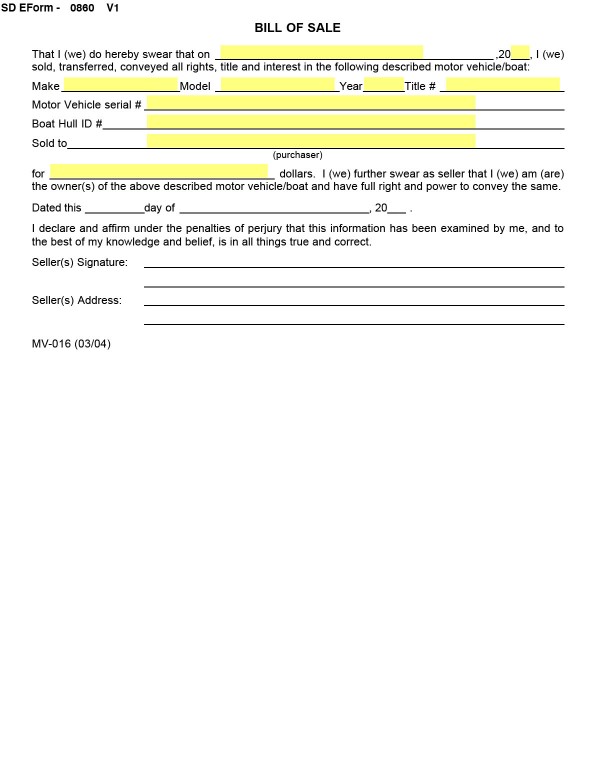

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

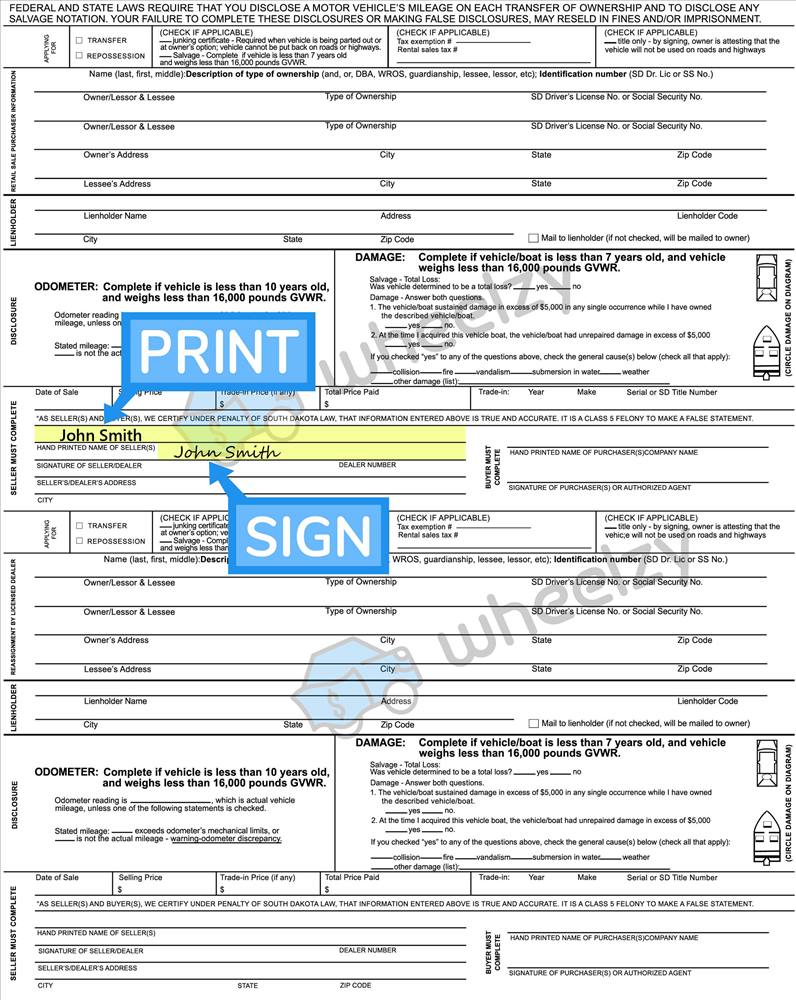

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

What To Do After A Hit And Run In South Dakota Bankrate

Bills Of Sale In South Dakota The Forms And Facts You Need

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

How To Sell A Car In South Dakota Getting The Correct Documents